It is March, a time when most people eagerly await the end of winter and embrace the first signs of spring. For me, the spring also marks the end of long days and nights spent walking the halls and occupying committee rooms in Richmond. The 2020 Virginia General Assembly session concluded on March 12, and by the time you read this, we will all be awaiting Governor Northam’s response to the legislation and budget passed by both houses.

Land Conservation Policy

Public policy decisions impacting land conservation in the Commonwealth.

What will tomorrow bring?

This year’s Virginia General Assembly promises to be an interesting one, as the November 2019 elections resulted in a change in leadership in both the House and the Senate. A new Speaker of the House (Filler-Corn), Senate Majority Leader (Saslaw) and large shifts in committee memberships of both bodies are among the changes. With Governor Northam still in office, the Democrats have consolidated control of state government for the first time in more than two decades. And that means we will see many of the priorities of the party at the forefront of the legislative agenda.

An Eye on Richmond

It’s that time of year. While most are consumed with thoughts about gifts for that impossible relative or honing survival skills for holiday parties, I find my mind preoccupied with Richmond and a new General Assembly session.

Speaking Up for Land Conservation

(By Rex Linville) My job with The Piedmont Environmental Council usually has me visiting farms and forests in Albemarle and Greene counties and advising landowners on conservation strategies for their property. But early this November, I found myself on Constitution Avenue in Washington, D.C. offering public comment to the IRS about proposed regulations that would adversely impact land conservation in Virginia…

New IRS Proposal Would Hurt Land Conservation in Virginia

On August 27, 2018 the IRS proposed new regulations changing how it would characterize state income tax credits (such as the Virginia Land Preservation Tax Credit “LPTC”) that are received when people make charitable gifts. If this rule passes, landowners who donate conservation easements would have to count the Virginia LPTC issued to them as a payment and their federal income tax deduction would be reduced by the value of the state tax credits received.

Your General Assembly Update

The beginning of spring marks the end of the 2018 Virginia General Assembly session. Well, sort of. In the case of the budget, there was no resolution, which means the fate of conservation funding and the general path forward is still up in the air. To address this, the Governor has announced that a special session will convene on April 11.

One of the bigger issues taking up bandwidth this year was Medicaid expansion. The House’s budget bill included the expansion, while the Senate’s bill did not — this set up a showdown in the budget conference committee. Due to this and other differences, the conferees were unable to come to an agreement, meaning it will be some time before we know what programs will be affected.

Advocating for Strong Land Conservation Policies

Successful land conservation requires action at all levels to protect the Commonwealth’s diverse landscapes. Land conservation is critical in achieving measurable goals on protecting water quality, water supply, climate resiliency, and the Chesapeake Bay. State agencies, local communities, and private individuals need the right tools to protect working farms and forests, scenic landscapes, natural areas, wildlife habitat and game lands, historic resources, and parks and recreational areas for Virginia’s present and future generations. Virginia currently has a variety of programs and approaches that can deliver lasting results across the Commonwealth.

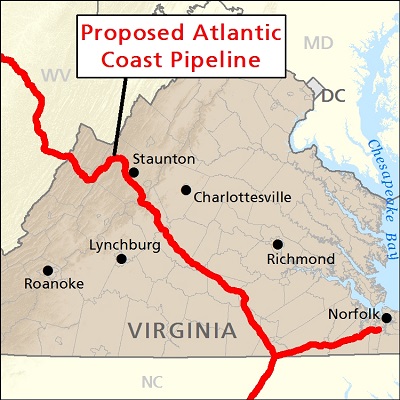

Regarding the Mountain Valley Pipeline (MVP) and Conservation Easements

PEC Comments to VOF on June 22, 2017: “…As we did at your February 9th meeting in regard to the Atlantic Coast Pipeline, PEC encourages the VOF Board to vote NO on the Mountain Valley Pipeline request for a 1704 Conversion/Diversion to allow an industrial access road through the “Terry Property” in Roanoke County…”

Regarding the Atlantic Coast Pipeline & Conservation Easements

A decision is being considered that could have a profound and lasting effect on the integrity of conservation easement programs in Virginia.

General Assembly eyes further cuts to land conservation

The Virginia General Assembly will kick off on January 11, 2017, and with a budget shortfall weighing heavily on the minds of our legislators, a lot of cuts are being discussed. Of particular concern is HB 1470, which would substantially reduce the tax incentives for land conservation.